My fellow Personal Finance blogger Michael Olafusi, who is also my blogging mentor, role model and friend wrote an interesting article about forex trading this morning that got me thinking about the last 8 years of my (forex) life, so I decided to share it with you.

On DAY 14, I already told you how I stumbled into Forex trading and where my gambler’s mentality came from. But what I didn’t tell you is why I continued trading Forex in spite of.

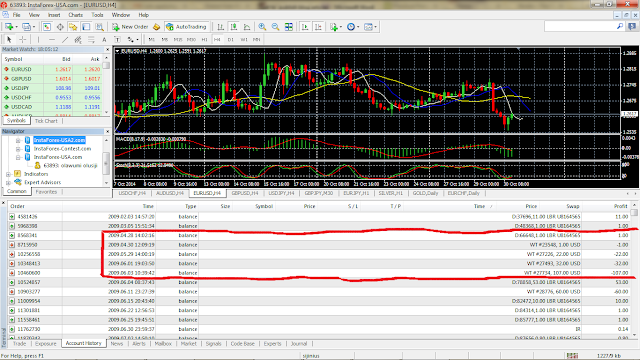

The picture above is the highest point in my Forex trading CV. Between April 28 and June 3, 2009, (trading infrequently using the internet cafe opposite my teaching hospital in Sagamu,) I took $1 to over $250 withdrawing along the way $1 (0n 30/04/2009), $22 (29/05/2009), $32 (01/06/2009) and finally $107 (03/6/2009), before I lost the rest and as you can see, I then transferred $53 back into the account again the next day (instead of $1- gambler's mentality) all through the defunct Liberty Reserve.

I was a live witness of the stock and Forex market crash of 2008 making money with Sola Oladipo, and losing money of course.

My Forex strategy was simple:

Start with a very small amount of money (that you can afford to lose again and again).

Perfectly look for the start of a trend.

‘Surf’ it with 1 maximum lot order per time (only 1 oh). Get out after 100 pips/doubling your balance.

Do exactly that again with a lot size corresponding to your new balance!

(And make sure to withdraw along the way before your account eventually drowns, because using this risky strategy, it will, surely, eventually, when you miscalculate the end of the trend!)

In all fairness, that really is what Forex trading is about, I only made it spectacular by the size of the lot, and the fact that I was trading more frequently, doubling my lot as my balance doubled.

Since then, I have turned $120 into $1,200 in 6 days. I have taken $150 to $3,200 in 1 week, and lost most of it in 24 hours (December, last year -the largest amount I have lost in one sitting!).

If I tell you I, Siji Olawumi can double your money in a Forex account in 24 hours that is not news. Even a newbie who learns Forex today can do that by luck.

If I tell you I can triple your Forex account in 24 hours, that’s great, but it’s still not news, after all, Forex trading offers such opportunities, more so, I have traded for more than 7 years now, so I have the experience to do that.

But what is actually news is that today I am yet to achieve my dream of becoming a Forex millionaire (in dollars of course), and that is the very reason why I won’t advise and don’t go about advising people to trade Forex. That is also the very reason my friends are baffled, and most wonder why I believed in and stuck with Forex ‘trading’ after losing my school fees and not being able to achieve my dream in more than 4 years. (Seyi, Cromie, Funmi, Bodex, Baka and Sola particularly.)

And even though I can do such things, I see myself as having failed myself, my friends and family particularly my dad, and of course, God who gave me the Forex skills in the first place. Why do I say so?

I am both a Forex trader and a Forex gamer (or what you more commonly call gambler/speculator), and it is very hard for me personally to draw the line between the two, or if I can totally say I have really, really dropped my gambler’s mentality. My friend -Sola Oladipo- will quickly tell you I am the latter. Lol.

Moreover, as I have been telling you on this platform for about 1 month now, God doesn’t want us to have a gambler’s mindset. He wants us to trust him with our finances and be faithful stewards.

Yes! I get thrilled from doing such things to the extent that I spent money like a Yahoo boy (when you are making money in dollars and spending in Naira, in Naija what do you expect? I am only just unlearning that spendthrift habit). And that is also why I don’t advise people to trade Forex unless:

1. They don’t have heart disease, or a strong family history of heart attack, and they are not prone to having suicidal tendencies. Lol. very funny. You can have a bipolar (manic/depressive disorder) personality though, that is Forex-trading-compatible. lol

2. They are matured, and have the discipline to sit in front of a system for 12 hours straight doing nothing except biting their nails as they see big negatives, or smiling to the bank as their trades show positive. Lol.

3. Seriously now, they have a mentor or tutor whom they follow, or a money mate to whom they are accountable. This is practically my most important tip. Some people don’t trade their accounts personally, rather giving it to the mentor to trade for them. While some others simply copy (forexcopy) the exact trades of Pros. Still, others put it into a fund that trades in Forex. If you are losing money regularly in forex, more than you are making, it's because you disregard this very important tip.

4. They have a strategy and they stick to it, no matter what. It is not about fear or greediness. Everyone has that. It is about principled trading that will override your fear or greed emotions when they show face. In Forex you can make money in 6 years and lose it all in 6 months. In fact, you can make millions in 6 months and lose it all in 6 hours. So if you don’t have and follow a trading strategy, don’t even bother trading, unless you are a gambler.

5. They have another, main source of income. So that Forex is just a source of multiple income for them. (That is not to say that there aren’t traders whose main source of income is Forex oh. But those ones are professionals.) When you lose the money in one source/if money isn’t coming from that source, you still get to survive, financially.

6. They are an institutional investment trader being strictly supervised by bosses -so they won’t end up like Nick Leeson, Toshihide Iguchi, or that Ghanian guy who cost Swiss bank UBS over $2 billion, what’s his name again sef?

7. They use robots and expert advisors to trade. Today even the best, biggest investment institutions use robots to trade alongside humans.

8. They know it's not biblical/wise to get rich too 'quick'. Great wealth too soon, that you are not mentally prepared for, will make you a poorer person at best, or affect your career, family and spiritual life negatively, at worst.

I am presently writing an e-book on the 40 different ways Nigerians make money online. There, I will encourage you with links, articles and resources if you think you still want to go into Forex trading (and speculating) in spite of all the negative things I have said about Forex doing to me, and the hard picture I have painted. Lol.

But for now, think about it, and look for a trader around you, intensively asking him/her (there are female traders, of course) any questions you want to ask, especially if s/he is your husband/wife, brother/sister, son/daughter or a banker.

They might just be like the house wife in Japan Yukiko Ikebe who turned $3000 into $8 million through patient daily Forex trading, or Jerome Kerviel who cost Societe Generale bank of France, $7 billion, also through unsupervised trading.

Updated: August 8th, 2020.

I really enjoyed reading this post, big fan. Keep up the good work andplease tell me when can you publish more articles or where can I read more on the subject? learn how to trade forex

ReplyDelete