Hello,

How are your finances? How much control do you have over your income and expenditure presently?

This post seeks to help clarify the misconception most people have about Money, and Currency/cash which is a subset of the former. And also look at how the government of developing countries like Nigeria, can make it extremely difficult to practice and master personal finance principles due to bad economic policies that weaken the economy and erodes the currency value/citizen's purchasing power.

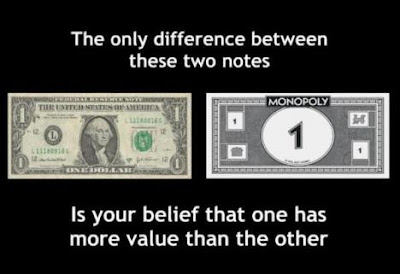

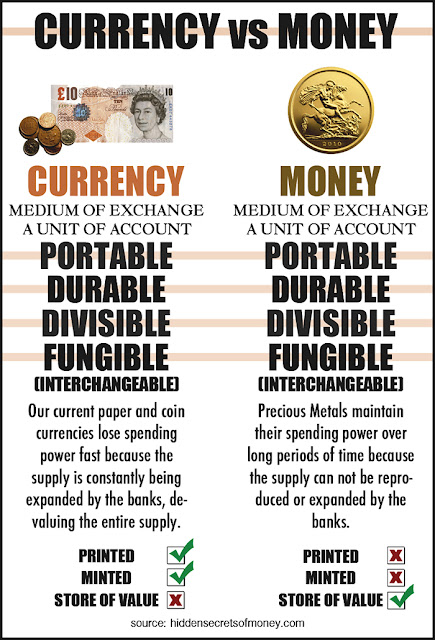

The difference between Currency and Money

But it was not so before when currencies had the gold and silver standard. However, over time, governments decide to start printing their currencies at will in order to meet up with rising expenditure, the result was currencies without a back-up of value. And this is why inflation greatly erodes our purchasing power over the years, whereas true money gains in value with inflation.

If I give you a bank check in my name to withdraw cash with at the bank, you trust in that paper I gave you because it was printed by a national bank accredited by the central bank. And you know that I know the legal implications if the check bounces (because there was no money in my account) and won't issue a dud check. That was the idea when currencies were printed with words written on it that said; "There had been deposited with the United States Treasury [$20] in gold payable to the bearer on demand".

Properties of cash:

- Portability (you can move it around)

- Durability (it lasts long)

- Divisibility (it was a unit of account that could be made into smaller units)

- Fungibility (it was interchangeable with another similar-looking note)

So money is anything that retains its value regardless of the inflation or a country's economic situation (of stagnation or recession).

You can watch the video below for more:

In countries like Nigeria, good (or bad) governance is the most important factor controlling personal finance

When our governments do not perform their statutory functions optimally to their citizens, they cause poverty in the society which adversely affect individuals' personal finance. People do not have enough to spend or save when governments waste or misappropriate state resources.

Recent events in Nigeria made me realise why developing economies have fewer personal finance bloggers compared to countries like USA. When government can suddenly, overnight, promulgate policies which directly reduce the buying power of the currency- causing widespread inflation and increasing the poverty index- personal finance bloggers like me instantly understand that if we must help people, we must also consider the economic policies of the government in power, and how to influence it for collective good.

People are bothered that the little they have today might even be worthless tomorrow due to rising costs of goods and services...so they do not want to save, and uncertain of investments in such an economy down the years.

Still, having money is better than holding currency

The key to making the most of your time/productive years, and achieving financial freedom eventually is still to find and keep money- as against currency. The truly rich always seek ways to do that.

Summarily, there is a major difference between having cash and having money. we must always seek to have and keep (real) money whenever, wherever.

This comment has been removed by the author.

ReplyDelete