After

writing the last article on my obsession to automate savings and investments

for myself and many others, I picked up the 2011 bestseller ‘Thinking, Fast and Slow’, by the Nobel Prize winner Daniel

Kahneman, and found some very useful tips. This article borrows heavily from

his wisdom and also from another classic by Nassim N. Taleb’s ‘The Black Swan’, on why it is futile

for humans – even supposed experts- to think we can always predict the future

(better than a mathematical formula or algorithm).

What

these authors -behavioural economists and psychologists- have come to find out

from numerous researches in a nut shell is: ‘Your biases and illusions, heuristic beliefs and assumptions might be

the greatest threats to you becoming wealthy’. My partner and co-founder ‘Bowale Banjoko will say “You are proud...and

your pride will keep you poor!”

I

lost over $2000

I always thought I could trade better than a robot so I did not bother getting one. But I

learnt the hard way recently when I became overconfident and cocky about

my Forex skills and transferred into my Forex accounts my highest amounts ever –disobeying

my own rules and amount limit for trading. And then I lost it all while chasing other

losses, thereby reinforcing the need for automation.

Efficient

formulas and algorithms are the key to human and organisational effectiveness

I

am convinced more than ever that what humans should bother (themselves) about

is ‘supervising’ emotion-less formulas and algorithms, dispassionate computer

systems and processes –tweaking them where necessary, and even changing them

completely as time goes on in order to make them more efficient, and humanity

more effective in achieving goals and set objectives.

It

is no coincidence that regulators expect investment firms to put the label “Past success is no guarantee of future

success” on their investment products. Not only is that very true, the three

books that I quote in this article prove that statement to be true in all

cases. And for any investment professional or institution to say otherwise is

to attempt to play God, and fail proudly.

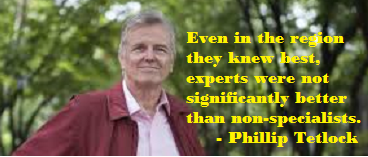

Nassim

Taleb’s Black Swan Events

In

The Black Swan, NNT shows us

‘experts’ often are not better than other humans in being able to correctly predict

events, even though they have acquired knowledge in that field, and spent years

practising (in) it. Yet, many of them think they are superhuman, and can

foretell unpredictable events such as knowing which baby will die of sudden infant death syndrome (SIDS); which company will go on to become a Unicorn- the next Facebook or Uber or

AirBnB; which child will be a genius and which one will end up as a recidivist

criminal if not a serial killer; whether the shares of Apple or Microsoft will

rise in the next quarter or be down this time next year, and so on.

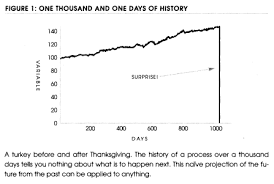

Taleb called such unpredictable events ‘Black Swans’. According to NNT, the black swan is an event, positive or negative, that is deemed improbable yet causes massive consequences. And a famous illustration he used is the Chrismas Turkey: Nothing on December 24th prepares or tells the Turkey that was being fed religiously every day from January 1st that it was going to be killed on the 25th by the same hands that had been feeding it.

The graph that was moving up perfectly, drops all of a sudden for that turkey without prior warning. And to believe we can always determine or correctly tell the future is to deceive ourselves.

|

| adapted from The Black Swan by Nassim Taleb |

Daniel Kahneman’s Thinking fast and slow

In Thinking,

Fast and Slow, Daniel Kahneman discusses illusions in the section Overconfidence,

including the illusion of understanding, the illusion of validity and

the illusion of stock-picking skill.

Kahneman mentions the report ‘Trading is hazardous to your wealth’ by the finance professors Terry Odean and Brad

Barber that showed that on average, the most

active traders had the poorest results, while the investors who traded the

least earned the highest returns. Other researches show that individual

traders eventually lose all their money to established institutions that mostly

trade through automated systems.

He continues in ‘The illusion of pundits’, “As Nassim

Taleb pointed out in The Black Swan, our tendency to construct and believe

coherent narratives of the past makes it difficult for us to accept the limits

of our forecasting ability. Everything makes sense in hindsight, a fact that

financial pundits exploit every evening as they offer convincing accounts of

the day’s events. And we cannot suppress the powerful intuition that what makes

sense in hindsight today was predictable yesterday. The illusion that we

understand the past fosters overconfidence in our ability to predict the

future.”

And in the chapter ‘Intuitions vs Formulas’, I quote

directly;

"Why experts are inferior to algorithms

One reason, which the psychologist Paul Meehl suspected,

is that experts try to be clever, think outside the box, and consider complex

combinations of features in making their predictions. Complexity may work in

the odd case, but more often than not it reduces validity. Simple combinations

of features are better. Several studies have shown that human decision makers

are inferior to a prediction formula even when they are given the score

suggested by the formula! They feel that they can overrule the formula because

they have additional information about the case, but they are wrong more often

than not.

According to Meehl, there are few circumstances under

which it is a good idea to substitute judgment for a formula. In a famous

thought experiment, he described a formula that predicts whether a particular

person will go to the movies tonight and noted that it is proper to disregard

the formula if information is received that the individual broke a leg today.

The name “broken-leg rule” has

stuck. The point, of course, is that broken legs are very rare—as well as

decisive. Another reason for the inferiority of expert judgment is that humans

are incorrigibly inconsistent in making summary judgments of complex information.

When asked to evaluate the same information twice, they frequently give

different answers. The extent of the inconsistency is often a matter of real

concern. Experienced radiologists who evaluate chest Xrays as “normal” or “abnormal”

contradict themselves 20% of the time when they see the same picture on

separate occasions.

A study of 101 independent auditors who were asked to

evaluate the reliability of internal corporate audits revealed a similar degree of

inconsistency. A review of 41 separate studies of the reliability of judgments

made by auditors, pathologists, psychologists, organizational managers, and

other professionals suggests that this level of inconsistency is typical, even

when a case is reevaluated within a few minutes. Unreliable judgments cannot be

valid predictors of anything.

The widespread inconsistency is probably due to the

extreme context dependency of System 1. We know from studies of priming that

unnoticed stimuli in our environment have a substantial influence on our

thoughts and actions. These influences fluctuate from moment to moment. The

brief pleasure of a cool breeze on a hot day may make you slightly more positive

and optimistic about whatever you are evaluating at the time. The prospects of

a convict being granted parole may change significantly during the time that

elapses between successive food breaks in the parole judges’ schedule. Because

you have little direct knowledge of what goes on in your mind, you will never

know that you might have made a different judgment or reached a different

decision under very slightly different circumstances.

Formulas are

unemotional and consistent

Formulas do not suffer from such problems. Given the same

input, they always return the same answer. When predictability is poor—which it

is in most of the studies reviewed by Meehl and his followers—inconsistency is

destructive of any predictive validity.

The research suggests a surprising conclusion: to maximize predictive accuracy, final

decisions should be left to formulas, especially in low validity environments.

In admission decisions for medical schools, for example, the final

determination is often made by the faculty members who interview the candidate. The evidence is fragmentary,

but there are solid grounds for a conjecture: conducting an interview is likely

to diminish the accuracy of a selection procedure, if the interviewers also

make the final admission decisions. Because interviewers are overconfident in

their intuitions, they will assign too much weight to their

personal impressions and too little weight to other sources of information,

lowering validity.

The most important development in the field since

Meehl’s original work is Robyn Dawes’s famous article “The Robust Beauty of

Improper Linear Models in Decision Making.” The dominant statistical practice

in the social sciences is to assign weights to the different predictors by

following an algorithm, called multiple regression, that is now

built into conventional software. The logic of multiple regression is

unassailable: it finds the optimal formula for putting together a weighted

combination of the predictors. However, Dawes observed that the complex

statistical algorithm adds little or no value. One can do just as well by

selecting a set of scores that have some validity for predicting the outcome

and adjusting the values to make them comparable (by using standard scores or

ranks). A formula that combines these predictors with equal weights is likely

to be just as accurate in predicting new cases as the multiple-regression

formula that was optimal in the original sample. More recent research went

further: formulas that assign equal weights to all the predictors are often

superior, because they are not affected by accidents of sampling.

The formula

for marital stability

The surprising success of equal-weighting schemes has

an important practical implication: it is possible to develop useful algorithms

without any prior statistical research. Simple equally weighted formulas based

on existing statistics or on common sense are often very good predictors of significant outcomes. In a memorable example, Dawes

showed that marital stability is

well predicted by a formula:

frequency of lovemaking minus frequency of quarrels

You don’t want your result to be a negative number.” (lol)

frequency of lovemaking minus frequency of quarrels

You don’t want your result to be a negative number.” (lol)

APGAR SCORE:

the algorithm that has saved millions of babies

“The important conclusion from this research is that

an algorithm that is constructed on the back of an envelope is often good

enough to compete with an optimally weighted formula, and certainly good enough

to outdo expert judgment. This logic can be applied in many domains, ranging

from the selection of stocks by portfolio managers to the choices of medical treatments

by doctors or patients. A classic application of this approach is a simple

algorithm that has saved the lives of hundreds of thousands of infants. Obstetricians

had always known that an infant who is not breathing normally within a few minutes

of birth is at high risk of brain damage or death. Until the anesthesiologist Virginia Apgar intervened in 1953, physicians and midwives used their clinical

judgment to determine whether a baby was in distress. Different practitioners

focused on different cues. Some watched for breathing problems while others

monitored how soon the baby cried.

Without a standardized procedure, danger signs were

often missed, and many newborn infants died.

One day over breakfast, a medical resident asked how

Dr. Apgar would make a systematic assessment of a newborn. “That’s easy,” she

replied. “You would do it like this.” Apgar jotted down five variables (heart

rate, respiration, reflex, muscle tone, and color) and three scores (0, 1, or

2, depending on the robustness of each sign). Realizing

that she might have made a breakthrough that any delivery room could implement,

Apgar began rating infants by this rule one minute after they were born. A baby

with a total score of 8 or above was likely to be pink, squirming, crying, grimacing, with a pulse of 100 or more—in good shape.

A baby with a score of 4 or below was probably bluish, flaccid, passive, with a

slow or weak pulse—in need of immediate intervention. Applying Apgar’s score, the

staff in delivery rooms finally had consistent standards for determining which babies were in trouble, and the formula is

credited for an important contribution to reducing infant mortality. The Apgar

test is still used every day in every delivery room.

Atul Gawande’s recent A Checklist Manifesto provides many other examples of the virtues of

checklists and simple rules.”

[According to the book, ‘thinking

fast’ refers to that part of our brain denoted by the psychological

term System 1 which operates automatically and quickly, with little or no effort and no

sense of voluntary control. While ‘thinking slow’ refers to System 2 which allocates attention to

the effortful mental activities that demand it, including complex computations.

The premise of the book is that it is easier to recognize other people’s

mistakes than our own.]

Tony

Robbins says don’t take the Money game more seriously than you should

In

the book Money Master the Game,

which I already reviewed extensively here, Tony Robbins talked about the myth

of believing the $13 Trillion lie (of ‘financial investment experts’): ‘Invest

with us, we will beat the market’. Only very few, rare people have the luck of

having beaten the market consistently, the others are only ‘lucky’ occasionally

and fail often. And Tony went on to explain that though individual investors

always seek the next ‘Star’ investment fund to put their money in, it is always

better to invest as part of a system/low-priced mutual fund that mimics the

market.

Individuals

cannot on their own (‘expert judgment and skills’) beat the market overtime especially

trading against organised, well established institutions with deep pockets and

advanced algorithms. It is even foolhardy to try.

Automations

already exist, find the best one for you

Finally

however, I must state that there are out there in the world so many automated

systems and apps for savings, investments, and budgeting, and there are

thousands of corporations/societies/networks that help people make the right

choices.

Many,

I have mentioned on this blog in the past including Acorns, Mint, Digit, YNAB,

America'sbest401k, Lifetimeincome,

Money Master the Game’s financial app, and so on.

The

problem is that many of them do not take into account people living in Africa

and other developing economies, or do not have bespoke solutions for our unique

environment.

So

while I am trying to do my bit for the developing world, I urge you to become

obsessed with finding a system that helps make your life easier where you are presently.

So

if you want to invest, find and invest with a good low-priced Funds management

team, or if you are looking to trade online in Forex or stocks or binary options or sports betting, you can buy/rent/install a tested software or robot,

or employ a good programmer to automate your strategy for you.

Also,

if you want to utilise the power of a network, then find and join a good

savings and loans society (or cooperative society if you are in Africa) with

objectives similar to your life values. For those in the developed world, such

websites as Lending club, Prosper, Upstart and a host of others already offer these easily, you will do

well to use them. Read up reviews on popular websites and blogs so that you are

armed with adequate information about them.

I

wish you all the best. Cheers!

N.B:

The APGAR score is not the only algorithms used in Medicine today. By the

time I graduated from medical school, all hitherto-subjective clinical exams

had been replaced by a more objective OSCE,

in which the expected answer to clinical questions was graduated against scores.

Now, the medical student has to perform the clinical examination the right way and

could score all the marks available or no mark at all. Gone is the subjective victimisation

by professors of their students due solely to (past) biases, halo effect or personality

idiosyncrasies and illusions.

No comments:

Post a Comment