|

| Credit: fortcollinscopier |

.

Yes, stop throwing cash at emergencies as you just might be throwing money away.

What do I mean?

Most times in life, we are faced with one emergency challenge or another. And our immediate response is to avoid it or try to solve it with the method of least resistance that will not upset our comfort zone.

Are you afraid of a court case?

Do you always look for quick fixes?

Are you too shy to tell someone off?

Do you say No! when you should, or you rationalize for others who aren't doing the same for you?

Would you rather pay more money than bargain/haggle/negotiate, or buy at the first stall to avoid walking further inside the market, etc?

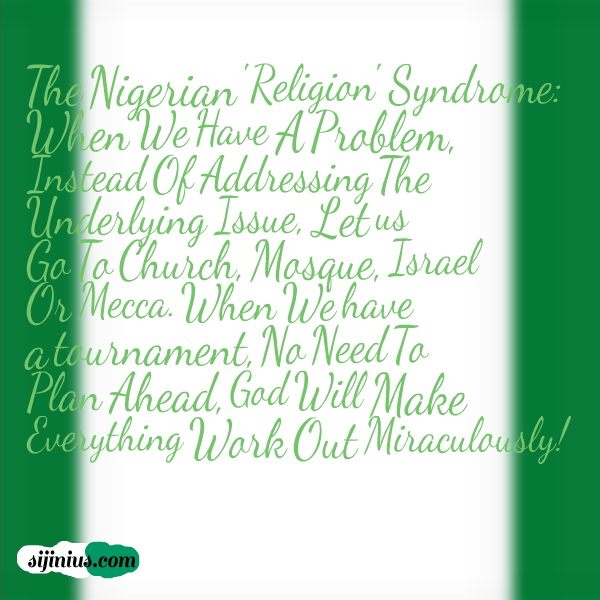

Listen, you need to anticipate and prepare for financial problems. That is a given. You need a budget, or to follow it if you do. But one of the worse things you can do is to go religious about your challenges, or believe that money can and should solve people problems. (I call it "The Nigerian syndrome" -trying to solve all your troubles with money or religion).

Solutions: How To Solve Emergencies Without Throwing Cash At It

Anticipating troubles correctly is the first step to avoiding (financial) troubles. Like I said in 101 ways to spend less in Nigeria (tip 113), Mind your own business; most people fall into financial troubles, debt and other mess mostly due to the fact that they don't mind their own business.

However, many other times, we fall into financial shark-infested waters when we neglect important things that are not urgent until they become extremely devastating or overwhelming -a case of misplaced priorities.

In my life and family, I look back at the way my dad solved some difficult troubles he got into through me (when I lost my school fees in forex trading) and on different occasions when he tried to use cash to solve problems involving my mum, and then my step mum, that required non-monetary solutions majorly (- facing facts, and sincere listening and talking through them). Because of these, my dad (and us) is poorer today than he used to be.

Prioritize

I used to be guilty of not prioritizing. But I found out I wasn't effective in life, and worse, I always ended up broke without achieving my dreams or ideas --a case of a blacksmith who puts all the swords in the fire at the same time. Result: "None gets hot enough to be beaten into shape."

Let me give you specific examples of urgent things that we think are emergencies, and some others that we try to use money, or 'prayer/miracle' to solve instead of addressing the underlying issues, especially as Nigerians.

A phone call: most of us think that we need to pick a call immediately it comes in. Or, that once you get a thought to call someone, then you should do so immediately. Most times (at least 8 out of ten times) I have discovered that there is no urgency about calls. Only very few times are calls very very urgent. Some of you will see a missed call and call back only to discover that it was someone who wanted to ask a favor, or a 'wrong-number' call, or even worse, a fraudster.

[My policy is that if you want a favor, you must use your own credit to ask it.

I make it a point of duty to follow this principle. If I need a favor from you and you missed my call, only to call me back later, I will tell you to hang up so I can call back. Some people have a bad habit of doing the opposite. I only overlook this policy for students/children, of course]

It is a true statement that your phone might be the reason why you are poor and ineffective.

A personal bad habit/character flaw that refuses to go away: Don't try to wish away or explain away whatever bad habit you have acquired over time. Don't try to pray it away either when you have to diligently work on yourself. A character flaw has to be accepted and then worked on, sometimes even to the point of seeing a counselor or going for rehabilitation. Don't sleep with another's spouse, don't borrow with the intention of not paying back, don't backstab or take the credit that belongs to others, don't go to a bar if you have an alcohol addiction, and so on.

A difficult or unruly child/spouse/colleague/boss/person: Everyone tries to avoid troublesome or difficult people. We don't like the pain that comes with trying to be at peace with them. But most times instead of spending cash to run away from tackling your spouse's bad behavior head on,

or continuing to fund your child's bad habits at the expense of disciplining them;

instead of going the other way when you see your difficult boss coming in your direction;

or looking away from correcting a societal ill or injustice, we should address the main issue and not avoid it. Else it will come back to hurt us financially and in ways we did not think possible.

Call them for a heart-to-heart meeting and patiently listen to them, you will be shocked that even the most difficult person has some softness in some part of his/her heart.They only want to be heard and understood, that's all.

An unplanned change in plans, or not planning at all: Sometimes we try to anticipate all the things that can go possibly go wrong and put in place measures to tackle them. Yet with our best efforts things still find a way to go wrong whether you are planning a wedding, a birthday party, a trip, starting a business or whatever.

But often we are also guilty of not planning at all. We hinge our hopes on free-styling, or what you can call 'impromptu response'. We are reactive instead of proactive.

Have you heard of Murphy's law: Anything that can go wrong will go wrong. Yes, if anything can go wrong, it will. But Murphy's law isn't the real issue as much as how you react to urgently important things when they have become emergencies.

In the 7 Habits of Highly Effective People, Stephen Covey expounds more on this in Habit 3: Put first things first. You can get and read the book if you haven't. [Don't forget as is my custom on this blog, you can contact me for any ebook you want. And I will do my utmost to get it for you, or give you access to a site where you can read/listen to it.]

In summary, when emergencies come up, regardless of whether you have an emergency fund or not, money should not be the first thing that comes to your mind. Try to find the underlying issue every time and nine out of ten times, you will be able to solve the problem without spending cash at all, or a lot of it, if you have to.

Many people are poorer today because they ignore this very important money/life principle.

No comments:

Post a Comment