Welcome back to my review series of the book; Money Master the Game. I reviewed chapter one last week, and this week I will give an overview of the 9 myths Tony Robbins dispels in order to help his readers (- primarily Americans, for whom the book is targeted) take control of their financial future by becoming investment-savvy. He calls them ‘landmines’ that can blow up our financial future if not avoided.

We need to understand that to become financially independent, we must save regularly from our income, and then invest our ‘life savings’ wisely in safe investments. Yet, we need to know what we are doing as that is the only way to maximise returns and not end up giving most of our profits to brokers, or as taxes to the government.

The core concept of successful investing is simple: Grow your savings to a point at which the interest from your investments will generate enough income to support your lifestyle without having to work.

Section 2 Become The Insider: Know The Rules Before You Get Into The Game

Chapter 2.0 Break free: Shattering the 9 financial myths

Chapter 2.1 Myth 1: The $13T lie: “Invest with us. We’ll beat the market”

Chapter 2.2 Myth 2: “Our fees? They are a small price to pay”

Chapter 2.3 Myth 3: “Our returns? What you see is what you get”

Chapter 2.4 Myth 4: “I’m your broker, and I am here to help”

Chapter 2.5 Myth 5: “Your retirement is just a 401(k) away”

Chapter 2.6 Myth 6: Target-date funds: “Just set it and forget it”

Chapter 2.7 Myth 7: “I hate annuities, and you should too”

Chapter 2.8 Myth 8: “You gotta to take huge risks to get big rewards”

Chapter 2.9 Myth 9: “The lies we tell ourselves”

.

From the chapter outline above, you have already seen the 9 myths.

I will give a brief overview below.

|

| Tony Robbins |

Myth1: Here, Tony shows us that most traders and mutual fund managers do not beat the market over time. About 96% of actively managed mutual funds fail to beat the market over a sustained period of time. Yet they charge a lot of fees.

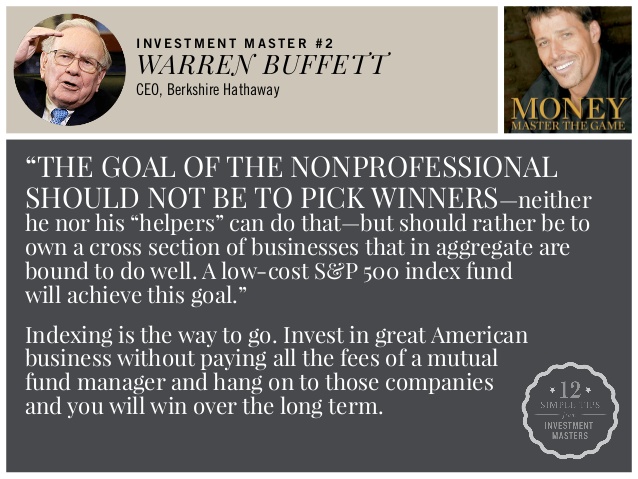

The unicorns are the few (4%) that beat the market consistently. The surest way to win consistently is to invest in a low-priced indexed fund.

Myth 2: Here the reader is shown that the average cost of owning a mutual fund is 3.17% per year. And while you might think that is a small amount, it makes a whole lot of difference in the long run on the returns on your compounded investment portfolio. A 2% annual fee is enough to reduce your returns by 50% over the long haul, yet there are about 10 different fees mutual fund managers charge their clients, effectively reducing the returns on their investments. Use www.personalfund.com to analyse how much fees you are currently paying.

Myth3: Most of the returns advertised by fund managers aren’t what investors/clients actually get. The brokers show you what they want you to see, most of the returns goes into their (broker’s) own pockets, not the investors.

Myth4: An expert fund manager has no obligation to help you make money- only a fiduciary does. In fact many investment brokers do not invest in their own funds’ portfolios. While they, brokers, claim to have your best interest at heart, they are really looking out for themselves.

Myth 5: The fact that an American has his/her retirement savings in a 401(k) doesn’t mean the savings are necessarily most effectively and safely invested- they have to ensure that personally. But employers have a legal obligation to invest their employees’ retirement/pension funds with the best available 401(k) manager. The book mentions America’s Best 401(k) as a company determined to give every American worker the best return for their 401(K) retirement savings.

Myth 6: Most Americans believe that investing in a Target-Date fund guarantees they won’t lose money, will definitely give guaranteed returns and also ensure they can retire at the arrival -‘Target date’- year of the fund. Tony shows us that TDFs are not the goal in itself, but simply an asset allocation (of your retirement fund) that should get less risky in its diversification as you approach retirement age.

Myth 7: All annuities are not bad. While there are annuities with bad terms and conditions- variable annuities, there are also many that guarantee a regular income for life, if properly set up. The website www.lifetimeincome.com help link Americans up to an annuity specialist to cater for their specific needs.

Myth 8: Benjamin Graham says in The Intelligent Investor, that “An investment is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

You don’t have to risk much to attempt to gain little. In fact the top and best investors risk little to gain much. We must look for investments that promises high returns for minimal risks. And they include

- Structured notes

- Market-linked CDs

- Fixed Index Annuities

Myth 9: The ultimate thing that stops most of us from making significant progress in our lives is not somebody else’s limitations, but rather our own limiting perceptions or beliefs. The last myth is the lie we tell ourselves and hold on to, that hinder us from financial success.

If you don’t succeed, it is your fault- not another’s. The ball is in your court.

No comments:

Post a Comment